Last week, I published an article on the causes and consequences of negative interest rates. In it, I talked briefly about how negative yields hold significant implications for gold as an asset class. In this follow up article, I will explain why that is.

Capital and Negative Yields

Capital in waiting – that is capital sitting on the sidelines waiting for a good investment opportunity – typically gets parked in government bonds. This is true for a number of reasons. Bonds are less speculative compared to most assets. The only risks are a sudden rise in yields (which has been de minimis in our decade long falling trend) or a fall in the denominated currency if it’s a foreign bond. Of course, some governments and jurisdictions are less appealing than others, as anyone with exposure to Greek bonds will tell you.

Despite a less than perfect track record, government bonds are still considered the “risk free” asset. Setting aside whether or not they truly are“risk free” (they aren’t) they are certainly less risky than buying a stock, or trading a commodity, or purchasing a piece of real estate. In the former two options you risk immediate adverse price exposure with every tick, and in the latter, there are natural liquidity restraints.

Additionally, the bond market is the only market big enough and liquid enough to absorb these large stocks of capital. Think about all the money in the bank. Make no mistake, there is little to no physical cash sitting in the bank. Nearly all deposited funds are moved into another asset at the bank’s discretion and within regulatory restraints. Typically, these are bonds.

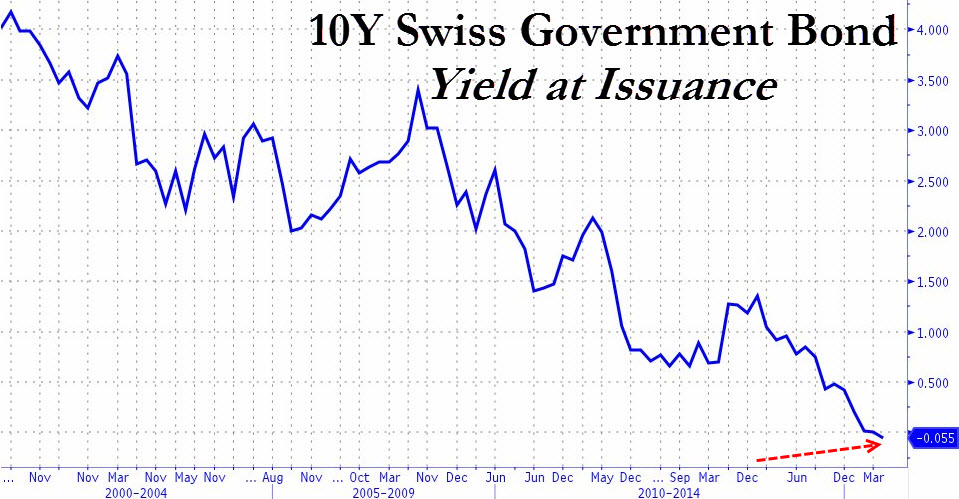

In bonds, this capital earns a small yield. Given the decade long declining trend in interest rates, this yield earned has been falling, falling and falling some more. Due to our modern monetary madhouse, we now see negative yields in some government bonds. The following chart shows the yield curves for Japan and Germany from 3 months out to 15 years.

That’s not the worst of it. The 10-year Swiss Bond is currently trading at -0.338 yield. We will come back to this number later.

Gold and Negative Yields

As opportunities for yield in the marketplace decrease, capital in search of better opportunities must now consider the adverse effects of being charged a negative yield in order to play it safe. In such an environment, non-yielding assets, which at one point may have looked unattractive, will begin to look much more attractive when compared to negative yielding bonds.

What happens to be the largest non-yielding financial asset in today’s financial markets? I’m glad you asked.

It’s gold.

The market for gold is deep enough and liquid enough to attract large amounts of capital under similar market conditions as government debt. However, unlike government debt, gold has no counterparty risk. Therefore, the true bearer of the title “risk free asset” should belong to gold – not T-bills or any other names government paper promises have. This is because gold is liquid under nearly all conceivable market conditions.

Of course, there is a cost to buy and store gold. But in our negative yield environment, if the cost of buying and storing gold is either equal to or close to the negative yield your capital would earn in a government bond, then we would expect a portion of that capital to flow into gold instead of the government bond.

Gold or a Negative Yielding Swiss Bond?

Let’s revisit that 10-year Swiss bond yield of -0.338. If you were to consider putting $10 million in a 10-year Swiss Bond, you would be paying $33,800 to own that asset. If you could acquire gold bullion stored in the secure vault of a trusted third party for 0.25% annual storage and insurance costs, then your cost of allocating the same amount of capital only comes to $25,000. Yes, there is price exposure with gold but there is also price exposure with foreign government bonds denominated in a different currency. Simple alternative analysis shows that there will at least be some portion of capital that will opt for gold over the government debt. This is especially true in a post-2008, post-Cyprus, post-Greece financial environment. Many will still remember the pain of being burned in one, or all three of those events.

As we wrote in our previous article, in a negative rate environment banks may have to choose between the lesser of two evils — two negative rates. Gold offers a materially different and compelling bid on large amounts of capital that needs to parked and preserved for the future.

It’s important to remember that this kind of optionality wasn’t on the minds of most people 10 years ago. But it is now a reality that many are facing. In fact, we would expect the flow of capital into gold to be commensurate with yields falling further into negative territory. Moreover, if any of the large government debt players go bust, like Japan for instance, then the effect ought to resemble that of pouring gasoline on the fire.

In conclusion, negative yields lower the relative opportunity cost of owning gold compared to other assets owned for similar reasons.

A version of this article was originally published here.