The playas gon’ play

Them haters gonna hate

Them callers gonna call

Them ballers gonna ball

I, I don’t mind

What people say or do

But I, I do mind

What you believe is true

– 3LW, Playas gon’ play

For an asset with an estimated market cap of ~$9 Trillion1, gold sure has a lot of haters.

That’s nothing new. History is replete with outspoken opponents of gold; from the “golden cross” speech of William Jennings Bryan2 to John Maynard Keynes’ labeling the gold standard a “barbarous relic”3 to Nobel Laureate Paul Krugman recently calling gold “dead”4.

Haters gonna hate. While the criticisms of gold are as many and varied as its critics, here we want to focus on what I think is the chief and best criticism of gold criticism, at least in the last half-century.

Gold is not a productive asset. It is a zero or negative yielding asset.

Even the stoutest of goldbugs can’t venture a rebuttal here, because it’s evidently true. Gold does not produce a yield5.

The Goliath of Gold

If there ever was a champion of this idea, it’s Warren Buffett. He hasn’t been shy with his opinions on gold over the years and his 2011 Letter to the Shareholders of Berkshire Hathaway is an excellent summary of his thoughts.

Pages 17-19 is the money section. Sandwiched between a truly timeless summary of investment wisdom, Buffett tears into the yellow metal. Understanding the context is important. Buffett divides all kinds of investments into three different categories. I’ve labeled the three categories below and included a few choice quotes from each.

Category I is comprised of “Investments that are denominated in a given currency [and] include money-market funds, bonds, mortgages, bank deposits, and other instruments.”

Most of these currency-based investments are thought of as “safe.” In truth they are among the most dangerous of assets. Their beta may be zero, but their risk is huge…Over the past century these instruments have destroyed the purchasing power of investors in many countries, even as the holders continued to receive timely payments of interest and principal.

Even in the U.S., where the wish for a stable currency is strong, the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire. It takes no less than $7 today to buy what $1 did at that time.

Today, a wry comment that Wall Streeter Shelby Cullom Davis made long ago seems apt: “Bonds promoted as offering risk-free returns are now priced to deliver return-free risk.”

Category II “involves assets that will never produce anything, but that are purchased in the buyer’s hope that someone else…will pay more for them in the future.”

This type of investment requires an expanding pool of buyers, who, in turn, are enticed because they believe the buying pool will expand still further. Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future.

Category III is Buffett’s favorite; “investment in productive assets, whether businesses, farms, or real estate.”

Whether the currency a century from now is based on gold, seashells, shark teeth, or a piece of paper (as today), people will be willing to exchange a couple of minutes of their daily labor for a Coca-Cola or some See’s peanut brittle. In the future the U.S. population will move more goods, consume more food, and require more living space than it does now. People will forever exchange what they produce for what others produce.

Why Warren Buffett is Wrong

Buffett places gold in the second category of assets that are “sterile” and “never produce anything.” Specifically, he says;

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

Now, I am a great admirer of Warren Buffett and his partner Charlie Munger. The more I read their writings and study their doings, the more I admire them. What they have accomplished is truly incredible and there is little doubt in my mind that they are the greatest investors of our time and maybe even of all time.

So before I tell you how wrong Mr. Buffett is, I’d like to first tell you how right he’s been. He deserves it. Buffet’s comments on gold have been spot on for a very long time, about 85 years to be exact. Ever since gold was banished from its monetary role in civilization, it hasn’t been a productive asset and hasn’t produced a yield.

This was true for a very long time. But it’s not true anymore.

Why not?

Because a couple of years ago, during the spring (poetic!) gold did something it hadn’t done in a very long time. Gold produced a yield. It produced a yield not in dollars, but in more gold. The yield was 3.5% for one year. Meaning that if Mr. Buffett were to have placed 100oz in this opportunity, it would have returned him 103.5 oz. Monetary Metals & Co., the company I work for, did this.

I can’t fault Buffett for not knowing, and I don’t. But hopefully he knows better now.

Disclosure: As I just mentioned, I work for Monetary Metals & Co. The rest of this article is going to talk about what we’re doing and why I think it’s important. If you don’t want to hear about it, then consider this the end – gold hasn’t produced a yield in nearly a century, now it does. Buffet was right, now he’s wrong. I think this is very important news (gold producing a yield, not Buffett being wrong) but I understand if you may not. In any case, I thank you for reading this far.

Some Immediate Implications of Gold Yield

The reappearance of gold yield is significant for a number of reasons, some of them far-reaching. Let’s conclude by focusing on three immediate implications for gold yield.

One, it ought to make investing in gold more palatable. Despite plenty of compelling research which shows gold to offer improved risk-adjusted returns in portfolios6, many still shy away from it as an asset class. It gets labeled as fringe, alternative (in a pejorative sense), and only for those wackos who think the world is coming to an end. Sadly, much of that labeling is deserved. However, if gold were to pay 2-5% annually, then my guess is that a good percentage of those who weren’t comfortable before would be willing to give it another look, especially in today’s yield-starved investing environment.

Second, gold with yield improves the performance of gold in a portfolio. This is obvious but worth reiterating. Gold with yield should outperform all other conventional methods of owning gold by at least the yield earned7. And since nearly all methods of owning gold come with a cost, that out-performance should be even greater. The following graph illustrates the point.

This graph shows the backtest results of two model diversified portfolios; one with a 5% allocation to conventional gold, the other with a 5% allocation to gold which pays 3.5% annual yield, reinvested. The ending values are $701,448 and $858,889 respectively. The portfolio with gold yield outperforms by about 22%, in addition to having higher sharpe and sortino ratios8.

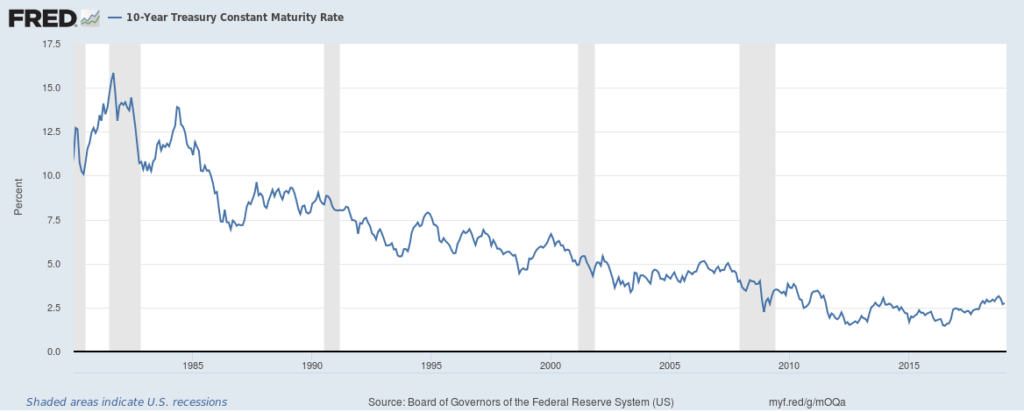

Thirdly, and perhaps most importantly, gold with yield offers a truly alternative savings vehicle to the US dollar. The dollar has proven itself to be a savings black hole over the long term. To date, it has lost close to 98% of its original value (measured in gold). But this is only one side of the dark force that is the dollar. There is another less understood, but no less pernicious, side – falling interest rates. Interest rates in the dollar system have been falling for nearly 50 years.

Since every asset trades at a spread to USD interest rates, this should be understood as a multi-decade decline in yield across every asset class9. There was a time when you could earn enough interest from bank deposits to save for retirement quite easily. Alas, such days are no more.

Gold has long been touted as a remedy for this i.e. “If you can’t save in dollars, then buy gold instead! Donch-ya-know it will keep its value?”

But there are problems with this. Buying and selling gold comes at a cost and there are tax implications for converting to dollars later. The bigger issue though is that while buying gold may help to preserve one’s wealth10, it doesn’t help to grow it. Without the ability to grow one’s wealth, that is to deploy capital productively (think Buffett’s third category of investments), then the task of savings becomes exponentially more difficult. This is true whether the capital is denominated in gold or dollars.

And that’s what the “gold as an alternative savings to the dollar” camp has been missing – the ability to grow one’s gold, make it work for you, deploy it productively, earn interest on it and compound it over time like any other investment/savings vehicle. This is precisely what we’re all about at Monetary Metals & Co.

What do you think?

Is the ability to compound gold a real game-changer? Or am I making a tempest in a teapot?

I’m betting on the former but I’d love to hear what you think and why. Let me know in the comments or send me a message here.

Footnotes:

Footnotes

- Source, WGC. Although, I think this number underestimates the global market for gold by a factor of 2-3x. For an in depth look at the global market for gold, I highly recommend this excellent report by the WGC – Liquidity in the global gold market. For a shorter read, I shamelessly direct you to an article I wrote years ago – How Big is the Gold Market and Why Does it Matter? For a fun visualization of how the gold market stacks up to other global markets, click here.

- https://en.wikipedia.org/wiki/Cross_of_Gold_speech

- https://en.wikiquote.org/wiki/John_Maynard_Keynes

- https://bitcoinist.com/paul-krugman-utility-dead-gold/

- By yield we mean income, in the form interest, dividends, coupons or fixed payments. We do NOT mean yield as the delta in the price of the asset.

- https://www.gold.org/goldhub/research/gold-investor-risk-management-and-capital-preservation-volume-1 to cite but one example

- Assuming a 100% rate of performance in the investment vehicles which offer gold yield.

- I used Portfolio Visualizer to perform the backtest and I used a custom data set for the 3.5% gold yield allocation. If anyone is interested in reviewing the results, let me know. I’d be happy to reproduce them.

- See Keith Weiner’s research on YPP – Yield Purchasing Power

- It should be mentioned this claim of gold to preserve wealth is non-linear. Despite goldbug claims to the contrary, it does lose ground against the dollar at times. The historical record shows that there have been multi-year periods of dollar strength where gold does not preserve one’s wealth. But even if that relationship was 100% linear, the bigger point is that preservation is not the same as growth.